Keppel’s privatisation offer: What an SPH shareholder with 1,000 shares can expect

SINGAPORE – Shareholders of Singapore Press Holdings (SPH) will get an opportunity to realise the value of their shares at a significant premium with Keppel’s privatisation offer, said SPH chief executive Ng Yat Chung.

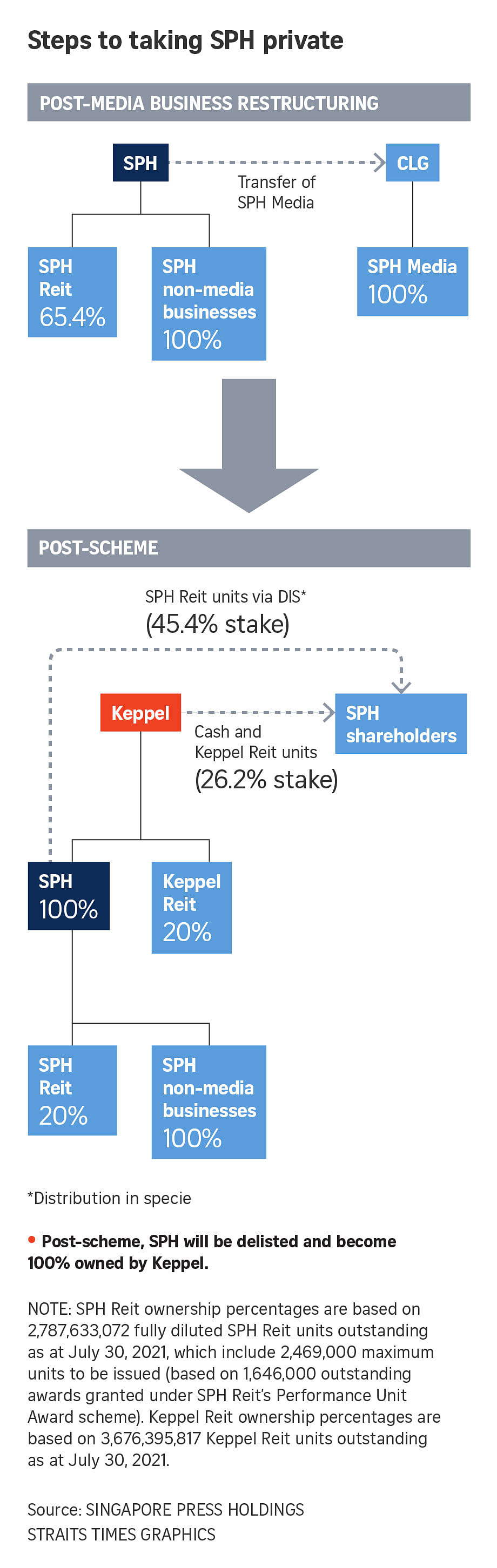

Speaking at a briefing on Monday (Aug 2) after the announcement of a $3.4 billion proposed deal to take SPH’s non-media business private, Mr Ng noted that the offer price of $2.099 per share represents a premium of about 40 per cent based on the last trading price before the announcement of SPH’s strategic review on March 30.

This means that, if a shareholder has 1,000 SPH shares, he will receive:

– $668 in cash;

– 596 Keppel Reit units valued at $715; and

– 782 units of SPH Reit units valued at $716.

This makes up a total consideration of $2,099. The illustrative values are based on Friday’s closing share prices.

Other benefits include:

– A final dividend for FY2021, instead of having it deducted; and

– Steady dividend yields in the 4 per cent range, based on the historical averages, for SPH Reit and Keppel Reit.

SPH Reit has a portfolio of retail properties including Paragon mall in Singapore and Figtree Grove Shopping Centre in Australia. Keppel Reit’s portfolio includes interests in Grade A commercial assets such as Ocean Financial Centre and Marina Bay Financial Centre in Singapore, along with assets in Australia and South Korea.

The proposed privatisation bid can go ahead only if the restructuring of SPH’s media business is completed, shareholders of both SPH and Keppel give the green light, and regulatory approval is obtained.