SPH decided to seek full offer for company to avoid chaos after hiving off media arm

SINGAPORE – The board of Singapore Press Holdings (SPH) wanted to minimise disruption to business operations once its media arm had been hived off – and the offer from Keppel ticked the most boxes.

SPH’s preference was to seek an offer for the entire company, and it spoke to more than 20 potential bidders in the process.

Speaking at a press conference on Monday (Aug 2) after Keppel’s offer to privatise SPH was announced, SPH chief financial officer Chua Hwee Song highlighted that one of the objectives of its strategic review was to avoid a “very chaotic period” which could arise after Newspaper and Printing Presses Act restrictions were lifted from SPH after its media business was hived off.

“In the end, the option which SPH landed on was to seek an offer for the whole SPH, so that a controlling shareholder can emerge,” said Mr Chua.

Under the Act, which regulates print media in Singapore, each ordinary shareholder can generally not hold more than 5 per cent of a newspaper company’s shares.

Keppel’s offer was selected after evaluating many proposals over a two-stage process in which more than 20 potential bidders had participated, he added.

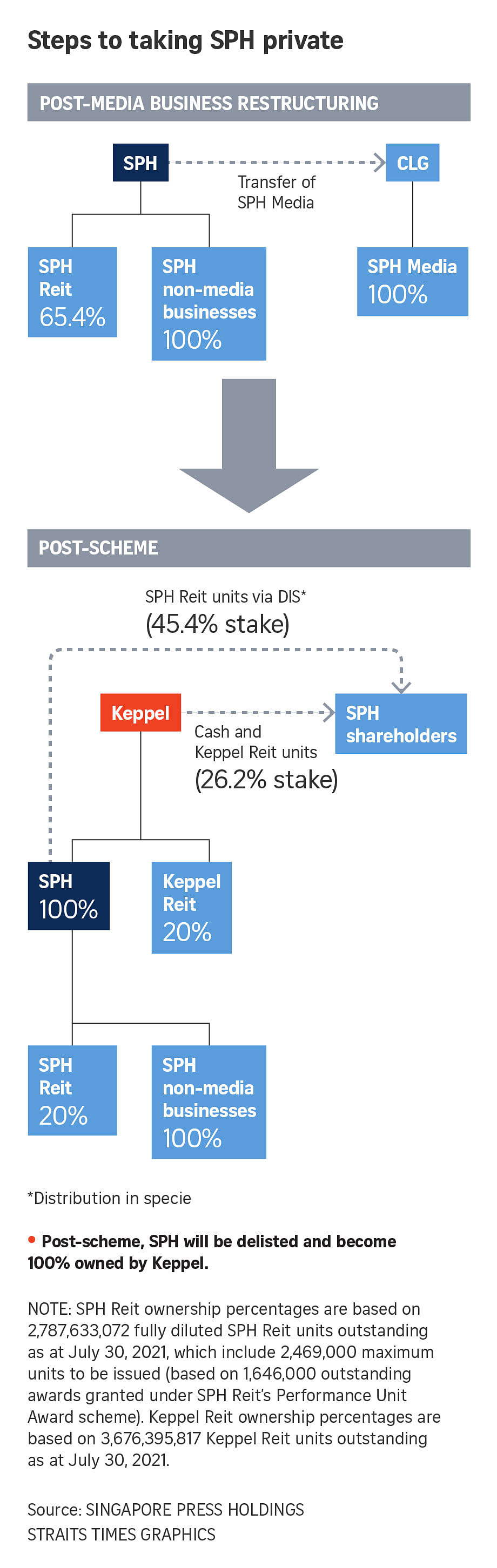

The proposal will require approval from both SPH and Keppel shareholders, and see SPH, which publishes The Straits Times, become a wholly owned subsidiary of the conglomerate.

The privatisation offer from Keppel is seen to provide the best overall value for shareholders as compared with maintaining status quo or a partial sale of assets.

Replying to questions on the offers received, Mr Ng said: “I’m not able to provide more information about competing offers because of confidentiality agreements, but this is the best offer that the SPH board has received.”

The offers it received were either those for partial ownership of 29 per cent of the company, parts of the company’s assets, or for the entire company, he added.

Offers were evaluated based on the certainty of financing, regulatory approval required, the structure of the proposed scheme and price.

Mr Chua said that the consideration of maintaining status quo was not possible without a controlling shareholder.

Partial sale of assets was also considered undesirable as SPH assets could be cherry-picked, leaving the company with debt and the challenges of monetising its remaining assets, he added, which drove SPH towards seeking an offer for the whole company.

Commenting on possible job cuts, Mr Ng noted that, in principle, every merger and acquisition deal has the possibility of rationalisation.

But in SPH’s case, Keppel is buying over the company to build on areas that SPH is strong in, and that augurs well for employees, he added.

“In our discussions with them… they are fully committed to integrating SPH’s personnel into the wider Keppel ecosystem and… my personal view is that with Keppel, the staff of SPH will have great opportunities for growth and career development in a much bigger ecosystem.”

At a separate media conference on Monday, Keppel chief executive Loh Chin Hua said in response to a question on retrenchment after the potential SPH acquisition: “This is about coming together.

“It is an acquisition where we see a lot of value especially in the SPH platform, such as the retail Reits (real estate investment trusts) and PBSA (purpose-built student accommodation) portfolio.”

He added that Keppel looks forward to welcoming SPH staff to the firm’s ecosystem and that it will have to form an integration committee “to look at some of these aspects later on”.

Mr Loh noted that it is “a bit early to say” if SPH management will be absorbed into Keppel, adding that it is growing its businesses under its Vision 2030 objectives and is always on the lookout for good people.